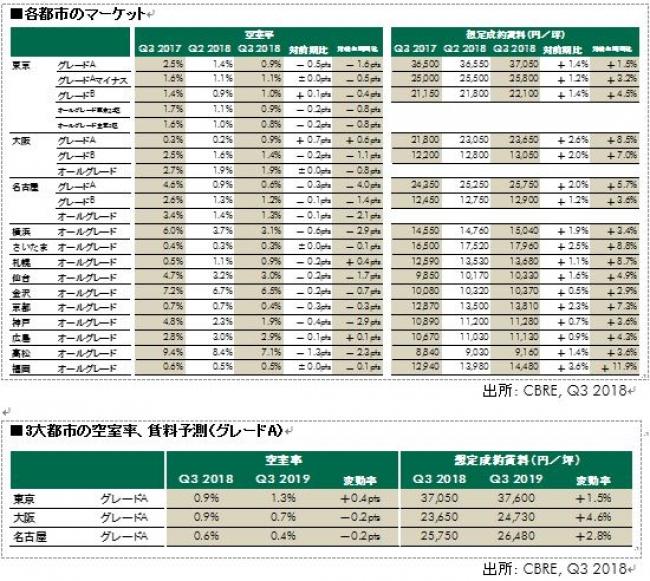

■ Tokyo All Grade Vacancy rate in the 23 wards of Tokyo (Q3) is -0 year -on -year.5 points 1.It was 7 %.In many industries, the business expansion demand is still strong.As the shortage of human resources is becoming more serious, many companies seek highly convenient locations that are advantageous for recruitment.In order to increase employee satisfaction, the movement to seek higher grades is also expanding.On the other hand, many companies are still cautious about costs.As a result, overall office demand is strong, but in high rent bands, signs of plateau have begun to be seen.Grade A vacancy rate of this term is -1 on the previous term.2 points 2.It was 5 %, declining for the second consecutive term.In this term, one grade A building was completed with full room.Among the large tenants who have moved to the building include a major telecommunications company that triggered the rebuilding of the relocation of the building.The fact that the building's recruitment rent was slightly lower than the recent market level of the new building, which seems to have led to a steady leasing.Grade a assumed contract rent for this term is 36,500 yen, 0 compared to the previous term..It was 6 %.However, in "Marunouchi / Otemachi", a slightly bullish rent settings were reviewed, and -0 year -on -year..It has fallen slightly as 1 %.Supported by strong office demand, the all -grade vacancy rate is expected to decrease next term.However, from 2018 to 2020, a total of 750,000 tsubo is available, focusing on Grade A Building.The relocation of the tenant relocation to a new building is likely to have secondary vacancies, and for tenants who are considering relocation in the future, the number of buildings will increase.On the other hand, the owner will be more competitive, and some buildings will be required to have a flexible response, including reviewing the rent conditions.CBRE expects Grade A rents to peak in the second half of 2017, and then decline slowly.Grade a rent at the end of 2018 is 6 for the 2017 Q3 results..It is expected to fall 2 %.Kazunori Umehara, a senior director of the Building Sales Division, said, "Office demand is still strong, and companies are also considering a building that is scheduled to be completed next year.Companies aiming for the room are also scattered. On the other hand, due to the increase in new supply, some buildings will increase the number of leasing time. "■ Osaka All -grade vacancy rate for this term (Q3) is -0 on the previous term.2 points 2.At 7%, the lowest ever since the start of Q1 in 1993 has been updated for three consecutive terms.In this term, one grade A building was completed in full room.Even with the relocation of the tenant relocating to the building, a job offer has already been made one after another.New opening and expansion needs are extremely vigorous, and there are tenants that are actively securing space.Grade A vacancy rate is -0 year -on -year.2 points 0.It was 3%, and the lowest value since the start of the 2005 Q1 survey was updated.Almost all the buildings of Grade A are full, and it is extremely difficult for tenants to move to a high -grade building.Grade A assumed contract rent is +1 from the previous term.It was 9 % 21,800 yen / tsubo.For the third consecutive term, the result of Tokyo and Nagoya has greatly exceeded the rise rate.Junichi Miyazaki, the CBRE Kansai Branch Director, said, "The tenants who need space early will need to think of securing, greatly loosen the relocation conditions, and speed up the relocation decision -making."■ Nagoya All Grade Vacuum Rate of Nagoya This term (Q3) is flat on the previous year 3.It was 4%.Previously, there were concerns about the occurrence of a large amount of secondary vacancy due to the Grade A Building, which was fully completed in Q1.However, there is almost no such vacant outbreak.In a large floor plate building, a transfer example has been concentrated for floor integration and expansion.Furthermore, there were some movements to actively improve the location with the relocation of the rebuilding due to the rebuilding.Nagoya Grade A vacuum rate is flat compared to the previous term 4.It was 6 %.Of the two Grade A buildings completed in Q1, leasing is time in a building with a large vacancy.This term, Grade A assumed contract rent is +0 year -on -year..6 % was 24,350 yen / tsubo. Recruitment rents have been raised in multiple buildings where vacancies have been reduced due to the expansion of the building. CBRE Nagoya Branch Senior Director Hideo Ogami commented, "Due to strong tenant demand, secondary vacancies are steadily digested. With the rise in occupancy, the demand for parking lots is becoming tight." increase. [Appealed in local cities] Kanazawa Rent recovers 10,000 yen for the first time in nine years. The highest rating rate of Kyoto rent is the highest in the country in Japan, accelerating the accelerated in the current term (Q3), all in local cities except "Takamatsu". The vacancy rate fell below 5 % in the city. Although demand is still strong, there is a lack of space that matches needs, and the relocation examples itself are decreasing. In "Saitama", "Sapporo", "Kyoto", and "Fukuoka", whose vacancy rate is already below 1 %, the lack of space is becoming more serious. Most cities have limited new supply in the future, so it is expected to continue in a solid supply and demand situation. In the Tokyo metropolitan area, a new building was completed in Yokohama, leaving a vacant room, and the vacancy rate has risen significantly. The assumed rent has risen in all cities except Takamatsu. In "Kyoto" and "Fukuoka", the rental pace is further accelerated, up 3%or more on the previous term. In "Sapporo", it is over 2 % year -on -year. "Yokohama", "Saitama", "Sapporo", "Kanazawa" and "Hiroshima" are more than 1 % year -on -year. Rent rising momentum is increasing in many local cities.

各都市のマーケットデータおよび市況の解説詳細は、10月30日発刊の「ジャパンオフィスマーケットビューQ3 2017」または弊社ホームページ上でもご覧頂けます。http://www.cbre.co.jp/JP/research/Pages/MarketViews.aspx

![It's hard to become "Oe"! Ultra-thin tongue cleaner with a thickness of 4 mm Newly released on July 1 [with a special case] It's hard to become "Oe"! Ultra-thin tongue cleaner with a thickness of 4 mm Newly released on July 1 [with a special case]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/10/3f1e5e995c1db97dc65a7883ef5de2cd_0.jpeg)